Infibee Technologies offers India’s No.1 SAP Tax and Revenue Management Training In Hyderabad, a comprehensive program designed to kickstart your career in SAP’s powerful taxation and revenue solutions.

Learn directly from industry-experienced professionals through live classes, hands-on mock projects, resume building, interview preparation, and placement training. With lifetime access to recorded sessions, our course includes real-world case studies and SAP applications such as tax determination, compliance reporting, tax configuration, automation, and reconciliation.

Key topics include: Introduction to SAP TRM, Public Sector Management (PSM), Taxpayer Registration, Returns Management, Payment Processing, Case Management, Compliance Checks, Revenue Accounting, Integration with SAP FI/CO, and Advanced Reporting.

Live Online :

This training in Taxation and Revenue Management with SAP in Hyderabad by Infibee Technologies promises to be the career-making initiative that opens the doors to deep functioning knowledge and practical experience on SAP’s taxation module.

This is explicitly meant for government and public sector revenue functions and aims at bridging the currently prevailing skill gap in the dynamically evolving SAP world. It fits anyone planning to start or boost a career in enterprise tax technology. With growing demand in India and worldwide, this advanced training covers all essential functions such as registration, taxpayer services, case handling, assessments, and revenue accounting through SAP solutions.

In the Taxation and Revenue Management with SAP training in Hyderabad, Infibee Technologies provides a hands-on approach in learning via industry-relevant projects, use-case simulations, and expert-led live sessions. Whether a fresher, a finance professional, or someone working in the public sector, this course provides the necessary tooling for handling real-world tax challenges using SAP. You shall cover everything ranging from tax compliance, tax payment, interfacing with SAP FI, and CRM for a complete development.

Why Choose Infibee Technologies for SAP Tax and Revenue Management Course In Hyderabad?

Key Highlights:

Best SAP Tax and Revenue Management Institute In Hyderabad – Get Certified with Infibee Technologies

One of the best options among Hyderabad’s SAP Tax and Revenue Management training centres, Infibee Technologies aims to certify professionals and prepare them for employment through a structured and practical teaching methodology. What infallibly confirms the institute’s status as the top program option is the dedication of Infibee to quality, accessibility, and learner success. The content for the courses is prepared by professionals from the industry who teach ideas with their practical experience, thus making it easy for students to understand the ideas and apply them in the business scenarios.

Our strength lies in assuring the adequate preparation of students for facing the global SAP certification exams confidently. The students further develop functional expertise through hands-on sessions and resolving doubts, project-related work, and simulation on tax environments. Our environment guarantees continuous education through post-course support, mentoring, and job alerts. We have been fostering excellence in training for decades, and we have placed hundreds of students in the best companies in India and overseas with great success.

Infibee’s training suits freshers, IT professionals, finance experts, and public sector employees interested in specializing in SAP TRM. Enroll now and join our growing alumni community.

Global Certification for SAP Tax and Revenue Management Training In Hyderabad

| S.No | Certification Code | Cost (INR) | Certification Expiry |

|---|---|---|---|

| 1 | C_TFIN52_67 | ₹21,000 | 5 Years |

| 2 | C_TAXADM_01 | ₹25,000 | 5 Years |

| 3 | C_S4FTR_2020 | ₹24,000 | 5 Years |

| 4 | SAP Certified Application Associate – Tax Compliance | ₹28,000 | 5 Years |

| 5 | SAP TRM Consultant Certification | ₹26,500 | 5 Years |

| Experience Level | Job Role | Salary Range (INR LPA) |

| Freshers (0–3 yrs) | SAP TRM Associate Consultant | 3–5 LPA |

| Junior SAP TRM Functional Analyst | 4–6 LPA | |

| SAP Tax Configuration Specialist | 4–6 LPA | |

| Mid-Level (4–8 yrs) | SAP TRM Consultant | 6–10 LPA |

| Senior SAP Functional Consultant | 8–12 LPA | |

| SAP Tax Compliance Analyst | 8–13 LPA | |

| Senior (9+ yrs) | SAP TRM Lead Consultant | 12–18 LPA |

| SAP TRM Project Manager | 15–22 LPA | |

| SAP Tax Solution Architect | 18–25 LPA | |

| Specialized Roles | SAP Public Sector Tax Analyst | 10–16 LPA |

| SAP Revenue Management Consultant | 12–18 LPA |

Step 1: Register for a Free Demo

Step 2: Select Your Training Mode

Step 3: Start Your SAP Tax and Revenue Management Journey

Make your career future-ready by joining the most trusted SAP Tax and Revenue Management Course In Hyderabad offered by Infibee Technologies. Get hands-on experience, certification guidance, and placement support—all in one place. Call us now or visit our website to book your seat and move one step closer to becoming a certified SAP TRM expert.

Upgrade Your Skills & Empower Yourself

Join the SAP Tax and Revenue Management Training in Hyderabad. Our syllabus covers the necessary methodologies of tax and revenue management, among other things. We include hands-on projects for the same under the supervision of industry experts, thereby helping you analyze the processes of tax and revenue in a flourishing technological hub like Hyderabad. Best suited for freshers and experienced professionals who look forward to taking their expertise in the areas of SAP Tax and Revenue Management a notch higher.

Attend SAP Tax and Revenue Management Classes in Hyderabad. Our course provides high-quality training with a firm foundation on core concepts and practical approaches. We will expose our participants to current industry use cases and scenarios for enhancing their skills and for executing real-time projects using best practices.

- Develop a system for automated tax return filing.

- Integrate with existing tax databases.

- Ensure compliance with tax regulations.

- Create tools to predict future revenue.

- Use historical data for analysis.

- Provide visual reports and insights.

- Build a portal for taxpayers to manage their accounts.

- Allow online payments and document submission.

- Offer support and information resources.

- Implement a system to identify potential tax fraud.

- Use predictive analytics and machine learning.

- Alert authorities of suspicious activities.

Educate your workforce with new skills to improve their performance and productivity.

Our Best SAP Tax and Revenue Management Training in Hyderabad has been designed to offer a comprehensive set of skills and practical knowledge on the subject. Objectives Equip you with mastering core concepts, applying your skills through real-world projects, critical thinking, and ensuring professional challenges that boost career development and contribute to the industry’s advancement.

SAP offers certifications such as SAP Certified Application Associate – SAP Tax and Revenue Management. These certifications validate your expertise in configuring and implementing tax and revenue management solutions.

Professionals can explore roles such as SAP Tax Consultant, Revenue Management Specialist, and SAP Functional Analyst, focusing on implementing and managing tax solutions in various organizations.

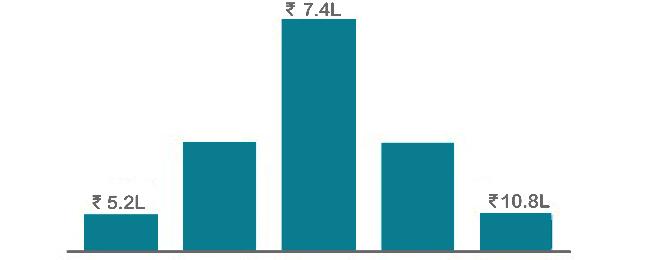

The average salary for an SAP Tax and Revenue Management consultant in India ranges from INR 8,00,000 to INR 15,00,000 per annum, depending on experience and expertise.

Career growth prospects are strong, with opportunities to advance to senior consultant roles, project management positions, or specialize in niche areas within tax and revenue management.

Key topics include tax configuration, compliance management, revenue accounting, and integration with other SAP modules like Financial Accounting (FI) and Controlling (CO).

Our Job Assistance Programme offers you special guidance through the course curriculum and helps in your interview preparation.

SAP Tax and Revenue Management is the most widely used programming language, and it is compatible with all computers as well as mobile devices without the need of an upgrade process. It has been ranked as one of the most lucrative jobs in the business world of software development, and students holding the SAP Tax and Revenue Management certification can garner an average salary of 7 LPA per year.

Infibee’s placement guidance navigates you to your desired role in top organisations, ensuring you stand out and excel in every opportunity.

You need not worry about having missed a class. Our dedicated course coordinator will help them with anything and everything related to administration. The coordinator will arrange a session for the student with trainers in place of the missed one.

Yes, of course. You can contact our team at Infibee Technologies, and we will schedule a free demo or a conference call with our mentor for you.

We provide classroom, online, and self-based study material and recorded sessions for students based on their individual preferences.

Yes, all our trainers are industry professionals with extensive experience in their respective domains. They bring hands-on practical and real-world knowledge to the training sessions.

Yes, participants typically receive access to course materials, including recorded sessions, assignments, and additional resources, even after the training concludes.

We provide placement assistance to students, including resume building, interview preparation, and job placement support for a wide range of software courses.

Yes, we offer customisation of the syllabus for both individual candidates and corporate also.

Yes, we offer corporate training solutions. Companies can contact us for customised programmes tailored to their team’s needs.

Participants need a stable internet connection and a device (computer, laptop, or tablet) with the necessary software installed. Detailed technical requirements are provided upon enrollment.

In most cases, such requests can be accommodated. Participants can reach out to our support team to discuss their preferences and explore available options.

We offer courses that help you improve your skills and find a job at your dream organisations.

Courses that are designed to give you top-quality skills and knowledge.

Upgrade Your Skills & Empower Yourself