Kickstart your career with India’s No.1 SAP Tax and Revenue Management Training In Bangalore offered by Infibee Technologies.

This course equips students and professionals with deep knowledge of SAP TRM modules, emphasizing real-time application and hands-on training. With industry-experienced experts guiding the sessions, learners gain expertise in Public Sector Collection and Disbursement (PSCD), SAP Tax Calculation Engine, Revenue Accounting, General Ledger Integration, Business Partner Management, Master Data Configuration, Forms and Correspondence, Case Management, and Integration with CRM and FI-CA.

Our training includes affordable fees, lifetime access to recorded live sessions, resume and interview preparation, and real-time mock projects. Get certified and become job-ready with one of the best SAP Tax and Revenue Management Course In Bangalore.

Live Online :

Infibee Technologies is offering an elaborate SAP Tax and Revenue Management Training in Bangalore at its institute to meet the widening needs of tax professionals, finance analysts, and IT consultants working with public sector organizations. Considered a highly specialized and technically demanding module able to manage the processes of tax collection, revenue accounting, and public sector disbursement, SAP TRM is.

The key objective of the course is making the learner grasp the various sub-components of the SAP TRM solution, which are Public Sector Collection and Disbursement (PSCD), Business Partner, Contract Accounts Receivable and Payable (FI-CA), as well as its extensions with CRM, FI, and other modules. This system, however, is being used by many government bodies and big organizations alike in automating and modernizing the tax and revenue functions.

Our trainers at Infibee Technologies help train students on real-time use cases and project simulations to prepare them competitively in the job market. The curriculum has been designed in such a way that the candidate is able to grasp configuration, customization, as well as its application in real-world scenarios. We offer lifetime access to recorded sessions and expert mentoring.

Why Choose Infibee Technologies for SAP Tax and Revenue Management Course In Bangalore? and Key Highlights:

Best SAP Tax and Revenue Management Institute In Bangalore – Get Certified with Infibee Technologies

When it comes to quality SAP Tax and Revenue Management Training In Bangalore, Infibee Technologies stands out as the best institute for aspiring professionals. Our institute is recognized for its cutting-edge curriculum, hands-on practical sessions, and a high success rate in placing candidates with top organizations.

Infibee Technologies offers a tailored learning journey that covers all critical components of SAP Tax and Revenue Management In Bangalore including PSCD, revenue posting, disbursements, and SAP CRM integration. Our experienced trainers not only teach but mentor students to become confident SAP TRM consultants. We maintain small batch sizes to ensure personalized attention and an interactive learning experience.

We understand the importance of flexibility and have thus introduced multiple modes of training: online, offline, and corporate batches. Every student gets lifetime access to recorded sessions, free resume consultation, and mock interview rounds to boost confidence.

What makes Infibee the best SAP Tax and Revenue Management Training Institute In Bangalore is our relentless commitment to quality and placement. Whether you’re a fresher or a working professional, Infibee Technologies helps you bridge the skills gap and empowers you to gain industry-recognized certification and land top-paying roles in the SAP ecosystem.

Global Certifications Available for SAP Tax and Revenue Management Training In Bangalore

| S.No | Certification Code | Cost (INR) | Certification Expiry |

|---|---|---|---|

| 1 | C_TFIN52_67 (FI/CO) | 35,000 | No Expiry |

| 2 | C_TFINS_66 (PSCD) | 40,000 | No Expiry |

| 3 | C_TS4FI_2021 (S/4HANA FI) | 45,000 | No Expiry |

| 4 | C_S4FTR_2021 (Treasury) | 42,000 | No Expiry |

| 5 | C_TS4CO_2021 (Management Accounting) | 40,000 | No Expiry |

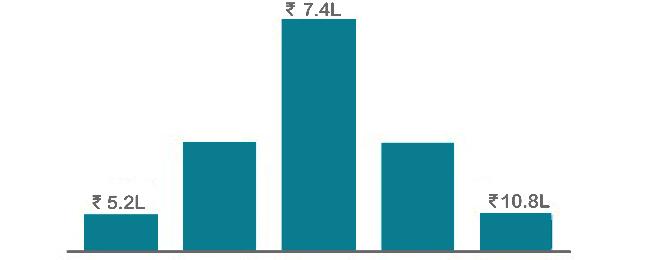

| Experience Level | Role | Average Salary (INR) |

| Freshers (0–3 years) | SAP TRM Associate Consultant | 3.5–5.5 LPA |

| SAP Tax Functional Analyst | 4–6 LPA | |

| SAP TRM Support Executive | 4–6.5 LPA | |

| Mid-Level (4–8 years) | SAP TRM Consultant | 6–9 LPA |

| SAP Tax and Revenue Lead Analyst | 8–12 LPA | |

| SAP FI-CA/TRM Functional Consultant | 9–13 LPA | |

| Senior (9+ years) | Senior SAP TRM Consultant | 14–18 LPA |

| SAP Public Sector Solution Architect | 16–20 LPA | |

| SAP TRM Project Manager | 18–25 LPA | |

| Specialised Roles | SAP PSCD Consultant | 12–18 LPA |

| SAP Tax Integration Specialist | 12–19 LPA |

Step 1: Register for a Free Demo

Step 2: Select Your Training Mode

Step 3: Begin Your SAP TRM Journey

Take your career to the next level with Infibee Technologies – the most trusted SAP Tax and Revenue Management Training Institute In Bangalore. Enroll today to master the future of tax technology with the best-in-class SAP Tax and Revenue Management Course In Bangalore. Whether you’re a fresher or a professional, our training prepares you for a successful and rewarding career in SAP Tax and Revenue Management In Bangalore.

Upgrade Your Skills & Empower Yourself

Join the SAP Tax and Revenue Management Training in Bangalore. Our syllabus covers the necessary methodologies of tax and revenue management, among other things. We include hands-on projects for the same under the supervision of industry experts, thereby helping you analyze the processes of tax and revenue in a flourishing technological hub like Bangalore. Best suited for freshers and experienced professionals who look forward to taking their expertise in the areas of SAP Tax and Revenue Management a notch higher.

Attend SAP Tax and Revenue Management Classes in Bangalore. Our course provides high-quality training with a firm foundation on core concepts and practical approaches. We will expose our participants to current industry use cases and scenarios for enhancing their skills and for executing real-time projects using best practices.

- Develop a system for automated tax return filing.

- Integrate with existing tax databases.

- Ensure compliance with tax regulations.

- Create tools to predict future revenue.

- Use historical data for analysis.

- Provide visual reports and insights.

- Build a portal for taxpayers to manage their accounts.

- Allow online payments and document submission.

- Offer support and information resources.

- Implement a system to identify potential tax fraud.

- Use predictive analytics and machine learning.

- Alert authorities of suspicious activities.

Educate your workforce with new skills to improve their performance and productivity.

Our Best SAP Tax and Revenue Management Training in Bangalore has been designed to offer a comprehensive set of skills and practical knowledge on the subject. Objectives Equip you with mastering core concepts, applying your skills through real-world projects, critical thinking, and ensuring professional challenges that boost career development and contribute to the industry’s advancement.

SAP offers certifications such as SAP Certified Application Associate – SAP Tax and Revenue Management. These certifications validate your expertise in configuring and implementing tax and revenue management solutions.

Professionals can explore roles such as SAP Tax Consultant, Revenue Management Specialist, and SAP Functional Analyst, focusing on implementing and managing tax solutions in various organizations.

The average salary for an SAP Tax and Revenue Management consultant in India ranges from INR 8,00,000 to INR 15,00,000 per annum, depending on experience and expertise.

Career growth prospects are strong, with opportunities to advance to senior consultant roles, project management positions, or specialize in niche areas within tax and revenue management.

Key topics include tax configuration, compliance management, revenue accounting, and integration with other SAP modules like Financial Accounting (FI) and Controlling (CO).

Our Job Assistance Programme offers you special guidance through the course curriculum and helps in your interview preparation.

SAP Tax and Revenue Management is the most widely used programming language, and it is compatible with all computers as well as mobile devices without the need of an upgrade process. It has been ranked as one of the most lucrative jobs in the business world of software development, and students holding the SAP Tax and Revenue Management certification can garner an average salary of 7 LPA per year.

Infibee’s placement guidance navigates you to your desired role in top organisations, ensuring you stand out and excel in every opportunity.

You need not worry about having missed a class. Our dedicated course coordinator will help them with anything and everything related to administration. The coordinator will arrange a session for the student with trainers in place of the missed one.

Yes, of course. You can contact our team at Infibee Technologies, and we will schedule a free demo or a conference call with our mentor for you.

We provide classroom, online, and self-based study material and recorded sessions for students based on their individual preferences.

Yes, all our trainers are industry professionals with extensive experience in their respective domains. They bring hands-on practical and real-world knowledge to the training sessions.

Yes, participants typically receive access to course materials, including recorded sessions, assignments, and additional resources, even after the training concludes.

We provide placement assistance to students, including resume building, interview preparation, and job placement support for a wide range of software courses.

Yes, we offer customisation of the syllabus for both individual candidates and corporate also.

Yes, we offer corporate training solutions. Companies can contact us for customised programmes tailored to their team’s needs.

Participants need a stable internet connection and a device (computer, laptop, or tablet) with the necessary software installed. Detailed technical requirements are provided upon enrollment.

In most cases, such requests can be accommodated. Participants can reach out to our support team to discuss their preferences and explore available options.

We offer courses that help you improve your skills and find a job at your dream organisations.

Courses that are designed to give you top-quality skills and knowledge.

Upgrade Your Skills & Empower Yourself