Infibee Technologies offers India’s No.1 GST Filing Training with global Certification & Placement Guidance.

Kickstart your career in GST Filing Course in Pune and master the art of accurate GST return filing, e-invoicing, and tax compliance under expert mentorship. Learn directly from 10+ industry professionals through real-time projects, case studies, and updated practical sessions that prepare you for high-demand taxation roles. Our program also includes resume preparation, interview guidance, placement training, and lifetime access to recorded live classes for continuous learning and skill enhancement.

Finally, Join our GST Filing Training Institute in Pune and ignite your career future with high-paying jobs in top companies.

Live Online :

Begin your career by enrolling in the GST Filing Course at Infibee Technologies in Pune, the best institute in India for professional tax and accounting training. Aimed at giving an in-depth understanding of Goods and Services Tax (GST) rules, filing steps, and compliance techniques to the learners, this course makes it easier for them to apply what they learned in school to the world of business through workshops.

The GST Filing Training in Pune is about teaching learners to file taxes using software, e-invoicing systems, and return management under the Goods and Services Tax regulation. It does not matter if a person is a graduate in commerce or a professional in accounting or even a business owner; this course will still enable him or her to carry out the GST processes by himself or herself and correctly. Infibee via expert trainers, practical assignments, and engaging sessions ensures that every single student learns practical skills and gets ready for the job.

This course is about the whole GST process—the very beginning to the end—namely registration, input tax credit management, GSTR filing, and reconciliation. Moreover, learners receive advice on audit readiness and compliance with government rules. Get on board with Infibee Technologies now and turn into a certified GST professional equipped with both confidence and competence.

| GST Filing Course in Pune Topics Covered | Applications of GST Filing Training in Pune | Tools Used |

|---|---|---|

| GST Registration & Structure | Business Tax Compliance | Tally ERP 9 |

| Input Tax Credit (ITC) | Filing GSTR-1, GSTR-3B, and GSTR-9 | GST Portal |

| GST Returns Filing | Accounting & Auditing Firms | Excel |

| E-Invoicing & Reconciliation | Corporate Taxation | ClearTax |

| Practical Filing Exercises | Freelance GST Consultancy | Zoho Books |

10+ years of industry-experienced tax professionals as trainers

100% placement guidance with interview preparation

Affordable fees and flexible learning options

Real-world GST filing case studies and mock projects

Lifetime access to recorded sessions and updated course material

Infibee Technologies, located in the heart of Pune, is recognized as a top GST Filing Training Institute in Pune for prospective accounting and finance experts. The institute has built its reputation on a very practical, job-oriented method of teaching, which combines academic concepts with real-world taxation scenarios.

At Infibee, the GST Filing Course in Pune are organized by certified experts who are well-versed in taxation and business accounting. Regular updates of the syllabus are made to keep pace with the latest amendments and government regulations. Furthermore, every student gets to practice it live with the use of professional GST tools, software, and portals.

Not only does Infibee Technologies provide technical training, but it also helps students in developing their analytical and problem-solving abilities which are important for employment and freelance consulting. Through personalized guidance, placement assistance and exposure to real-time projects, students are ready to manage GST processes for companies of any size with full confidence.

Certification Provided

Upon successful completion, students earn a recognized GST Filing Certification from Infibee Technologies. This certification validates your expertise in GST law, return filing, and reconciliation. It enhances your employability in accounting firms, MNCs, and taxation consultancies.

Our Alumni Are Working In:

TCS, Infosys, Wipro, Deloitte, Accenture.

Modes of GST Filing Course in Pune:

Classroom Training

Online Live Interactive Training

Corporate Training Programs

| S.No | Certification Code | Cost (INR) | Certification Expiry |

|---|---|---|---|

| 1 | GST Practitioner Certification | ₹10,000 | 3 Years |

| 2 | Tally with GST Certification | ₹8,500 | Lifetime |

| 3 | ICAI GST Certification | ₹12,000 | 5 Years |

| 4 | ClearTax GST Expert | ₹7,000 | 2 Years |

| 5 | GST Suvidha Provider Training | ₹9,500 | 3 Years |

Gain complete understanding of GST laws and structure

Learn accurate and compliant GST return filing

Work with top tax filing tools and software

Boost your employability in finance and accounting sectors

Become eligible for GST practitioner registration

Earn higher pay and career growth opportunities

GST registration, returns, and input credit

E-invoicing, reconciliation, and audits

Handling errors and amendments in GST

Using GST tools like Tally, ClearTax, and Zoho Books

Practical filing and compliance workflow

Commerce and Finance Students

Chartered Accountant Aspirants

Accounting Professionals

Business Owners & Entrepreneurs

Anyone looking for a stable taxation career

| Level | Job Role | Average Salary (LPA) |

|---|---|---|

| Freshers/Junior (0–3 years) | GST Assistant / Junior Accountant | 3–4.5 LPA |

| GST Executive / Tax Analyst | 4–5.5 LPA | |

| Mid-Level (4–8 years) | Senior GST Consultant | 6–9 LPA |

| Accounts & Taxation Manager | 8–12 LPA | |

| Senior/Experienced (9+ years) | Taxation Head / Compliance Manager | 12–18 LPA |

| GST Audit & Advisory Consultant | 15–20 LPA | |

| Specialized Roles | GST Practitioner / Tax Trainer | 10–15 LPA |

Deloitte

KPMG

Infosys

TCS

Ernst & Young (EY)

GST Filing Training is offered to other cities as well as GST Filing Training in Delhi, GST Filing Training in Hyderabad, GST Filing Training in Bangalore, and GST Filing Training in Chennai. While Infibee Technologies is providing hands-on training, experienced mentors, and placement support, which goes hand in hand with what candidates look for specifically in Pune, that is what makes us the number one choice.

Step 1: Register for a Free Demo

Visit our website and fill out the inquiry form.

Attend a free demo session to understand our training approach.

Step 2: Select Your Training Mode

Choose from classroom, online, or corporate training modes.

Pick convenient batch timings that suit your schedule.

Step 3: Start Your GST Filing Course in Pune Journey

Begin learning with our expert mentors.

Work on real GST filing projects and get ready for certification.

Join Infibee Technologies, the top-rated GST Filing Training Institute in Pune, and start your journey toward becoming a certified GST professional. With placement guidance, expert faculty, and real-world exposure, you’ll gain the confidence to handle GST processes efficiently and elevate your career to the next level.

Upgrade Your Skills & Empower Yourself

Join our GST Filing Training in Pune! Our syllabus covers essential GST filing methodologies, relevant tools, and advanced techniques. Our practical projects are led by industry experts, empowering you to manage GST filing processes effectively in this growing tech hub.

Enroll in our GST Filing Classes in Pune, where our course focuses on providing high-quality training with a strong foundation in core GST concepts and a practical approach to filing returns. Through exposure to real-world GST filing scenarios and current tax regulations, participants will enhance their skills and gain the ability to prepare and file GST returns accurately

Develop a software that automatically calculates GST. Ensure it can file returns directly with tax authorities. Include features for error-checking and compliance.

Create a tool to monitor GST compliance status. Track due dates and send reminders for filing. Offer a dashboard with compliance reports.

Design an app to assist small businesses with GST. Provide step-by-step guidance for filing returns. Include educational resources and tips.

Educate your workforce with new skills to improve their performance and productivity.

Our Best GST Filing Training in Pune aims to empower participants with comprehensive skills and practical knowledge in the field of GST compliance. The objectives focus on mastering core concepts of GST, applying skills through real-world GST filing projects, developing critical thinking to navigate complex tax regulations, and addressing professional challenges.

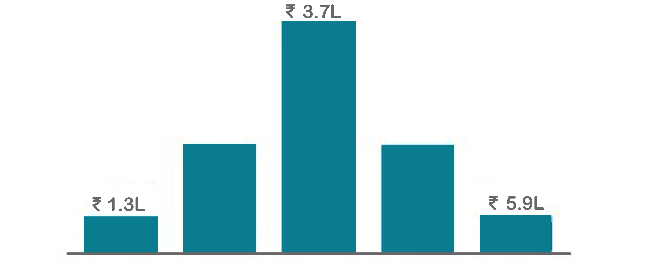

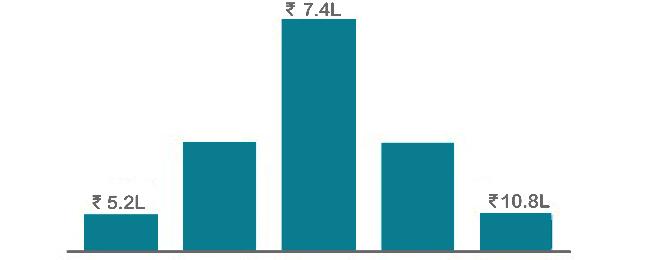

The average salary of a GST Filing Specialist in India ranges from ₹3-5 lakhs per annum for entry-level positions. For experienced professionals, the salary can increase to ₹7-10 lakhs or more, depending on the size of the organization and the complexity of compliance handled.

Yes, there are several certifications available for GST Filing professionals. The GST Practitioner Certification offered by the Indian government is a popular certification. Additionally, several institutes provide GST-specific certifications that focus on return filing, ITC, and tax compliance.0

A typical GST Filing course covers essential topics such as GST registration, return filing (GSTR-1, GSTR-3B, GSTR-9), Input Tax Credit (ITC) management, reconciliation of accounts, E-Way Bill management, and compliance with GST laws. Practical case studies and hands-on practice are also included.

The prerequisites for enrolling in a GST Filing course typically include a basic understanding of accounting and taxation. A background in commerce, finance, or accounting is helpful, but many courses start from the basics, so no specific degree is mandatory for entry-level courses.

After completing a GST Filing course, participants can explore career opportunities as GST Practitioners, Tax Consultants, GST Compliance Executives, Accountants, or Finance Managers. Many companies, especially in the finance and accounting sectors, require professionals to handle GST compliance and filing.

A GST Filing certification enhances career prospects by providing specialized knowledge in GST compliance, which is mandatory for businesses in India. Certified professionals are in high demand as they ensure legal adherence to tax regulations, making them valuable in accounting firms, corporate tax departments, and as independent consultants.

Our Job Assistance Programme offers you special guidance through the course curriculum and helps in your interview preparation.

GST Filing is the most common programming language, and it works on all computers and mobile devices without needing to be upgraded. It is one of the highest-paying careers in the software development industry, and those with the GST Filing certification can earn an average of 7 LPA per year.

Infibee’s placement guidance navigates you to your desired role in top organisations, ensuring you stand out and excel in every opportunity.

You need not worry about having missed a class. Our dedicated course coordinator will help them with anything and everything related to administration. The coordinator will arrange a session for the student with trainers in place of the missed one.

Yes, of course. You can contact our team at Infibee Technologies, and we will schedule a free demo or a conference call with our mentor for you.

We provide classroom, online, and self-based study material and recorded sessions for students based on their individual preferences.

Yes, all our trainers are industry professionals with extensive experience in their respective domains. They bring hands-on practical and real-world knowledge to the training sessions.

Yes, participants typically receive access to course materials, including recorded sessions, assignments, and additional resources, even after the training concludes.

We provide placement assistance to students, including resume building, interview preparation, and job placement support for a wide range of software courses.

Yes, we offer customisation of the syllabus for both individual candidates and corporate also.

Yes, we offer corporate training solutions. Companies can contact us for customised programmes tailored to their team’s needs.

Participants need a stable internet connection and a device (computer, laptop, or tablet) with the necessary software installed. Detailed technical requirements are provided upon enrollment.

In most cases, such requests can be accommodated. Participants can reach out to our support team to discuss their preferences and explore available options.

We offer courses that help you improve your skills and find a job at your dream organisations.

Courses that are designed to give you top-quality skills and knowledge.

Upgrade Your Skills & Empower Yourself