Infibee Technologies has established itself as providing #1 GST Filing Training in Hyderabad-a comprehensive and job-oriented program designed for students who want to have knowledge about GST laws, returns, and e-filing processes. The instructors cater to those commerce graduates, accountants, and finance professionals desirous of GST compliance and taxation workflows. While the course along with live GST software carries the participants through the practical process of return filing along with credit management and report generation, the proficient trainers of the institute ensure a blend of practical aspect with theory through live project experience, resume building, mock interviews, and career counseling to make candidates employable. Alongside, it offers all current updates on GST amendments and related regulatory practices. This training serves as a gateway into financially well-placed employment for freshers and working professionals alike.

Join the Most Trusted GST Filing Training Institute in Hyderabad today to walk towards a successful career in finance with 100% placement support and certification.

Live Online :

Infibee Technologies renders an extensive GST FILING Training in Hyderabad with the aim of inculcating into students, account personnel, and working professionals advanced practical knowledge and hands-on experience in dealing with GST returns and compliance. The curriculum covers every important learning aspect – GST registration, filing of returns (GSTR-1, GSTR-3B, GSTR-9, etc.), ITC reconciliation, TDS under GST, and e-invoicing. Our GST FILING Classes in Hyderabad would be best suited for you if you are just beginning your financial career or are interested in augmenting your tax knowledge as a whole, since it offers a solid foundation in the rapidly changing indirect tax system of India. The prime objective of the curriculum is to generate job-ready professionals who can confidently perform GST assignments in a real time corporate ambience. Through an expert mentoring team, live projects, and placement support, Infibee has gained recognition as the best GST FILING Training Institute in Hyderabad.

Key Highlights:

Infibee is your trusted partner in mastering tax compliance skills with practical insights and industry-relevant exposure.

Infibee Technologies is widely regarded as the Best GST FILING Training Institute in Hyderabad offering hands-on training led by top finance and taxation experts. Our training focuses on real-world application, making sure every learner becomes proficient in using the GST portal, reconciling invoices, filing returns correctly, and understanding compliance laws. With 1000+ learners trained and placed, our commitment is to turn you into a confident tax professional ready for various finance, audit, and accounts roles. Our GST FILING Classes in Hyderabad come with advanced tools, mock filing sessions, and job assistance to ensure career success. Join Infibee’s certified program today and gain practical expertise in GST filing—an in-demand skill across all industries. Begin your journey with the top-rated GST FILING Training in Hyderabad and add real value to your resume!

| S.No | Certification Code | Cost (INR) | Certification Expiry |

|---|---|---|---|

| 1 | GSTP-CERT-01 | ₹4,999 | Lifetime |

| 2 | NACIN – Govt. GST Course | ₹5,500 | 3 Years |

| 3 | Tally-GST Advanced Cert. | ₹3,500 | Lifetime |

| 4 | ICAI GST Certification | ₹6,000 | 5 Years |

Master GST returns filing & compliance

Hands-on training with GSTN portal

Gain in-demand job-ready taxation skills

Stay compliant with real-time updates

Increases earning potential for finance professionals

Opens freelance and consultancy opportunities

Boosts resume with practical GST certification

GST Basics, Types & Structure

Registration, Amendments, Cancellation

GSTR-1, GSTR-3B, GSTR-9 Filing

Input Tax Credit (ITC) Management

TDS/TCS under GST

E-Way Bill & E-Invoicing

GST on Imports & Exports

Practical Hands-on Portal Filing

B.Com/M.Com/CA/CS Students

Accountants & Finance Professionals

Tax Consultants

Business Owners & Freelancers

Entrepreneurs looking to handle their own GST

Job seekers wanting to enter finance or taxation

| Career Level | Job Role | Salary Range (INR LPA) |

|---|---|---|

| Freshers (0–3 yrs) | Junior GST Executive | 2.5–4.5 LPA |

| Tax Filing Associate | 3–5 LPA | |

| GST Compliance Trainee | 3.5–5.5 LPA | |

| Mid-Level (4–8 yrs) | GST Analyst | 5–8 LPA |

| Senior Tax Consultant | 6–10 LPA | |

| Indirect Tax Specialist | 8–12 LPA | |

| Senior (9+ yrs) | GST Compliance Manager | 12–16 LPA |

| Head of Taxation | 15–20 LPA | |

| GST Practice Lead | 18–25 LPA | |

| Specialised Roles | GST Auditor (Freelance/CA Firms) | 10–15 LPA |

| GST Trainer/Consultant | 12–18 LPA | |

| Government GST Advisory Roles | 15–22 LPA |

Here are top organizations hiring GST-skilled professionals:

Deloitte India

KPMG

Tata Consultancy Services (TCS)

EY India

Infosys BPM

Grant Thornton

ICICI Bank

Axis Bank

CA Firms & MSMEs

Startups & E-commerce Companies

Ready to master GST compliance? Join the most trusted GST FILING Training in Hyderabad at Infibee Technologies and get certified by industry experts. Whether you’re looking to boost your accounting career, become a freelance consultant, or handle your company’s GST filing, this course is your launchpad. Start with India’s top-rated GST FILING Classes in Hyderabad and elevate your financial skills. Choose Infibee—the #1 GST FILING Training Institute in Hyderabad—and take control of your career today!

Upgrade Your Skills & Empower Yourself

Join our GST Filing Training in Hyderabad ! Our syllabus covers essential GST filing methodologies, relevant tools, and advanced techniques. Our practical projects are led by industry experts, empowering you to manage GST filing processes effectively in this growing tech hub.

Enroll in our GST Filing Classes in Hyderabad, where our course focuses on providing high-quality training with a strong foundation in core GST concepts and a practical approach to filing returns. Through exposure to real-world GST filing scenarios and current tax regulations, participants will enhance their skills and gain the ability to prepare and file GST returns accurately

Develop a software that automatically calculates GST. Ensure it can file returns directly with tax authorities. Include features for error-checking and compliance.

Create a tool to monitor GST compliance status. Track due dates and send reminders for filing. Offer a dashboard with compliance reports.

Design an app to assist small businesses with GST. Provide step-by-step guidance for filing returns. Include educational resources and tips.

Educate your workforce with new skills to improve their performance and productivity.

Our Best GST Filing Training in Hyderabad aims to empower participants with comprehensive skills and practical knowledge in the field of GST compliance. The objectives focus on mastering core concepts of GST, applying skills through real-world GST filing projects, developing critical thinking to navigate complex tax regulations, and addressing professional challenges.

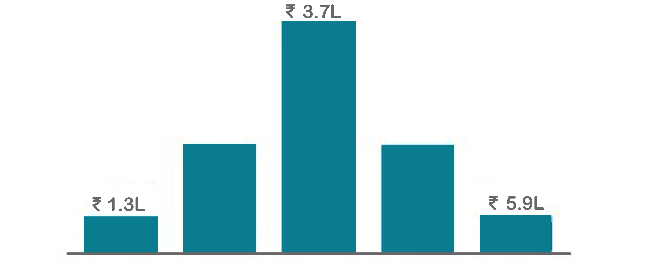

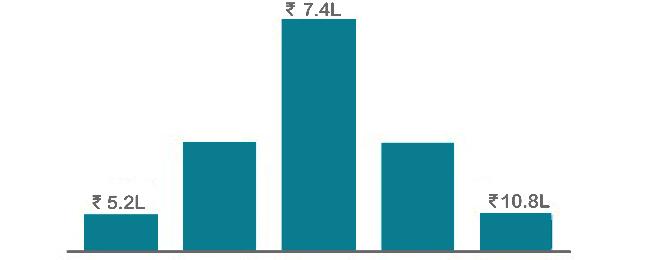

The average salary of a GST Filing Specialist in India ranges from ₹3-5 lakhs per annum for entry-level positions. For experienced professionals, the salary can increase to ₹7-10 lakhs or more, depending on the size of the organization and the complexity of compliance handled.

Yes, there are several certifications available for GST Filing professionals. The GST Practitioner Certification offered by the Indian government is a popular certification. Additionally, several institutes provide GST-specific certifications that focus on return filing, ITC, and tax compliance.0

A typical GST Filing course covers essential topics such as GST registration, return filing (GSTR-1, GSTR-3B, GSTR-9), Input Tax Credit (ITC) management, reconciliation of accounts, E-Way Bill management, and compliance with GST laws. Practical case studies and hands-on practice are also included.

The prerequisites for enrolling in a GST Filing course typically include a basic understanding of accounting and taxation. A background in commerce, finance, or accounting is helpful, but many courses start from the basics, so no specific degree is mandatory for entry-level courses.

After completing a GST Filing course, participants can explore career opportunities as GST Practitioners, Tax Consultants, GST Compliance Executives, Accountants, or Finance Managers. Many companies, especially in the finance and accounting sectors, require professionals to handle GST compliance and filing.

A GST Filing certification enhances career prospects by providing specialized knowledge in GST compliance, which is mandatory for businesses in India. Certified professionals are in high demand as they ensure legal adherence to tax regulations, making them valuable in accounting firms, corporate tax departments, and as independent consultants.

Our Job Assistance Programme offers you special guidance through the course curriculum and helps in your interview preparation.

GST Filing is the most common programming language, and it works on all computers and mobile devices without needing to be upgraded. It is one of the highest-paying careers in the software development industry, and those with the GST Filing certification can earn an average of 7 LPA per year.

Infibee’s placement guidance navigates you to your desired role in top organisations, ensuring you stand out and excel in every opportunity.

You need not worry about having missed a class. Our dedicated course coordinator will help them with anything and everything related to administration. The coordinator will arrange a session for the student with trainers in place of the missed one.

Yes, of course. You can contact our team at Infibee Technologies, and we will schedule a free demo or a conference call with our mentor for you.

We provide classroom, online, and self-based study material and recorded sessions for students based on their individual preferences.

Yes, all our trainers are industry professionals with extensive experience in their respective domains. They bring hands-on practical and real-world knowledge to the training sessions.

Yes, participants typically receive access to course materials, including recorded sessions, assignments, and additional resources, even after the training concludes.

We provide placement assistance to students, including resume building, interview preparation, and job placement support for a wide range of software courses.

Yes, we offer customisation of the syllabus for both individual candidates and corporate also.

Yes, we offer corporate training solutions. Companies can contact us for customised programmes tailored to their team’s needs.

Participants need a stable internet connection and a device (computer, laptop, or tablet) with the necessary software installed. Detailed technical requirements are provided upon enrollment.

In most cases, such requests can be accommodated. Participants can reach out to our support team to discuss their preferences and explore available options.

We offer courses that help you improve your skills and find a job at your dream organisations.

Courses that are designed to give you top-quality skills and knowledge.

Upgrade Your Skills & Empower Yourself