Infibee Technologies is the provides India’s No. 1 Tally Prime with GST Course in Bangalore, with global certificates and full placement support.

Jumpstart in your career by joining Tally Prime with GST training offered by 10+ industry experts through practical sessions, mock projects, and real-world accounting scenarios. Get lifetime access to recorded lectures, resume-building workshops, interview prep, and placement-grooming sessions all at the Affordable rates. Our course ensures productive hands-on knowledge relevant to actual-world usage of Tally Prime with GST.

Join our Tally Prime with GST Course in Bangalore and set your budding career ablaze with high-paying jobs at MNC companies.

Live Online :

Begin your journey with Infibee Technologies through the cardi-back Tally Prime with GST Training in Bangalore. This course is specially designed for students, professionals, and entrepreneurs who want advanced knowledge of accounting and taxation. With a focus on the current trends of GST compliance, financial reporting, payroll management, and software application, this training turns you into a job-ready candidate.

This Tally Prime with GST Course in Bangalore offers an ideal blend of theory and practical application. With exposure to accounting for business, preparing tax returns, financial management, etc., you will be valued for finance, accounts, and business operations.

| Course Topics Covered | Applications of Tally Prime with GST Course | Tools Used |

|---|---|---|

| Fundamentals of Tally Prime | Business accounting & bookkeeping | Tally Prime |

| GST Concepts & Return Filing | Taxation & compliance | GST Module in Tally |

| Payroll & Employee Management | HR & salary processing | Tally Payroll |

| Financial Reporting | Profit & loss, balance sheet, cash flow | Tally Prime |

| Inventory & Stock Management | Retail, trading & manufacturing sectors | Tally Inventory |

Training by 10+ industry-experienced faculty

Affordable fees with flexible learning options

Mock projects & real-time accounting case studies

Resume building & interview preparation

Lifetime access to recorded sessions

Globally recognized certification

100% placement guidance

Practical exposure to GST compliance and filing

Located at the center of Bangalore, Infibee Technologies is counted among one of India’s leading institutes for Tally Prime with GST Training in Bangalore. The motive was to bridge the gap between academic and industry needs through practical job-oriented training.

We take a hands-on approach to GST return filing, payroll processing, and real-time accounting scenarios with Tally Prime. With a systematic syllabus, interactive classes, and project-based classes, the Tally Prime with GST Course in Bangalore provides a solid way for students to be prepared for accounting jobs in small companies as well as big multinationals.

Our institute focuses beyond just teaching software; we also train learners for interviews, resume building, and real business scenarios. With valid placement assistance, many of our alumni are currently working successfully in MNCs and finance companies.

Upon finishing the Tally Prime with GST Training in Bangalore, learners get an industry-recognized certificate issued from Infibee Technologies. This certificate certifies that one has an expertise in accounting, GST compliance, payroll management, and business reporting in a Tally Prime environment. It engulfs the career and prominence which allure the job market in accounting, finance, and taxation.

Our alumni have secured positions in top MNC companies such as TCS, Infosys, Wipro, Cognizant, and HCL Technologies.

| S.No | Certification Code | Cost (INR) | Certification Expiry |

|---|---|---|---|

| 1 | Tally Certified Professional (TCP) | ₹10,000 | Lifetime |

| 2 | Tally Expert Certification with GST | ₹15,000 | Lifetime |

| 3 | GST Practitioner Certification (Govt. Approved) | ₹12,000 | 2 years |

| 4 | Advanced Tally Prime with GST Certificate | ₹18,000 | Lifetime |

| 5 | Microsoft Certified Finance & Operations (with GST modules) | ₹20,000 | 2 years |

Become job-ready in finance and accounting

Gain in-depth GST knowledge with compliance practice

Learn payroll, inventory & financial reporting

Access lifetime recorded sessions

Get certification with industry recognition

Affordable fees with flexible training modes

Placement training and interview guidance

Tally Prime fundamentals & navigation

GST concepts and return filing

Payroll & salary processing

Inventory management

Profit & loss, balance sheet, financial reporting

Real-time accounting with mock projects

Commerce & finance graduates

Job seekers in accounting and taxation

Working professionals in finance roles

Business owners & entrepreneurs

Anyone interested in GST & accounting

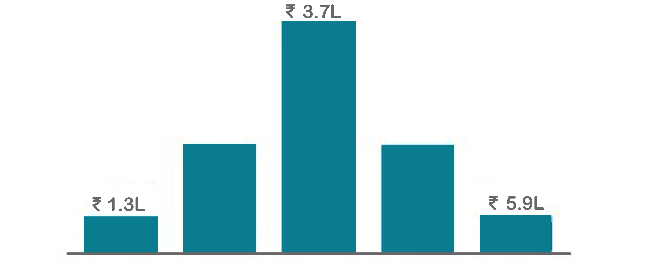

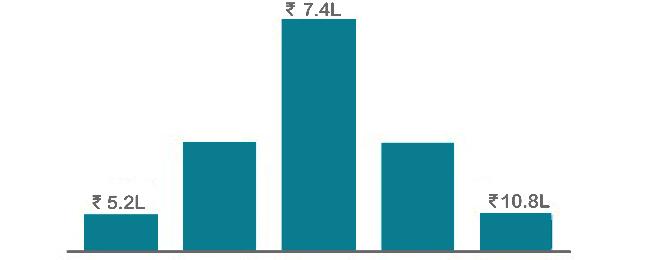

| Experience Level | Roles | Salary Range (LPA) |

|---|---|---|

| Freshers/Junior (0–3 years) | Tally Accountant, GST Executive, Accounts Assistant | 3 – 4.5 LPA |

| Mid-Level (4–8 years) | Senior Accountant, GST Specialist, Tally Prime with GST Lead | 5 – 12 LPA |

| Senior/Experienced (9+ years) | Tally Prime Consultant, Finance Manager, Head of Tally Prime with GST | 12 – 25 LPA |

| Specialized Roles | GST Auditor, Tally Prime with GST Specialist, Taxation Consultant | 10 – 20 LPA |

Infosys

Wipro

Deloitte

Accenture

HCL Technologies

Tally Prime with GST Training is offered to other cities as well as Tally Prime with GST Training in Chennai, Tally Prime with GST Training in Hyderabad, Tally Prime with GST Training in Pune, and Tally Prime with GST Training in Delhi. While Infibee Technologies is providing hands-on training, experienced mentors, and placement support, which goes hand in hand with what candidates look for specifically in Bangalore, that is what makes us the number one choice.

Step 1: Register for a Free Demo

Submit the inquiry form on our website

Attend a free demo session to experience our training

Step 2: Select Your Training Mode

Choose classroom, online, or corporate training

Select your batch timings based on convenience

Step 3: Start Your Tally Prime with GST Journey

Learn with experienced trainers

Work on real-time accounting projects

Prepare for certification and placement

Land yourself a job as a high-income earner in the field of Accountancy, GST Administration by taking the Infibee Technologies’ Tally Prime with GST Training in Bangalore.

Upgrade Your Skills & Empower Yourself

Join our Tally Prime with GST Training in Bangalore! Our syllabus covers essential accounting principles, Tally software functionalities, and GST compliance techniques.The training is led by industry experts, and our hands-on projects and practical sessions empower you to apply your knowledge effectively in real-world scenarios. Perfect for accountants, finance professionals, and tax consultants aiming to enhance their expertise in Tally and GST.

Enroll in our Tally Prime With GST Classes in Bangalore, where our course focuses on providing high-quality training with a strong foundation in core concepts and a practical approach. Through exposure to current industry use cases and scenarios, participants will enhance their skills and gain the ability to execute real-time projects using best practices.

Configure Tally for a retail business and implement GST-compliant invoicing, tax calculations, and reporting.

Reconcile GST data between Tally and government portals, identify discrepancies, and rectify errors to ensure accurate tax reporting.

Prepare tally data for the GST audit, generate audit reports, analyse compliance issues, and implement corrective measures to ensure audit readiness.

Educate your workforce with new skills to improve their performance and productivity.

Our Best Tally Prime with GST Training in Bangalore aims to empower participants with complete skills and practical knowledge in this field. Objectives provide you with mastering core concepts, applying skills through real-world projects, critical thinking, and ensuring professional challenges. This enhances career development and contributes to industry advancement.

Tally ERP 9 offers features such as GST invoicing, tax calculations, e-filing of returns, reconciliation of data with GSTN, and GST audit capabilities.

The average salary for a Tally with a GST professional ranges from $20,000 to $40,000 per year, depending on experience, skills, and location.

Yes, participants receive a certification upon successful completion of our Tally with GST training program, validating their proficiency in Tally software and GST compliance.

The duration of the Tally with GST course is typically 2 to 3 months, comprising both theoretical instruction and practical hands-on training sessions.

There are no specific prerequisites for enrolling in the Tally with GST course. However, basic knowledge of accounting principles and familiarity with computer operations would be beneficial.

Graduates of the Tally with GST course can pursue various career roles such as GST consultant, accounting executive, tax analyst, finance manager, auditor, or compliance officer in industries requiring GST compliance expertise.

Our Job Assistance Programme offers you special guidance through the course curriculum and helps in your interview preparation.

Tally with GST is a widely used accounting software that operates seamlessly across all computers and mobile devices without requiring frequent updates. It offers lucrative career opportunities in the software development sector, with certified professionals earning an average of 7 LPA per year.

Infibee’s placement guidance navigates you to your desired role in top organisations, ensuring you stand out and excel in every opportunity.

You need not worry about having missed a class. Our dedicated course coordinator will help them with anything and everything related to administration. The coordinator will arrange a session for the student with trainers in place of the missed one.

Yes, of course. You can contact our team at Infibee Technologies, and we will schedule a free demo or a conference call with our mentor for you.

We provide classroom, online, and self-based study material and recorded sessions for students based on their individual preferences.

Yes, all our trainers are industry professionals with extensive experience in their respective domains. They bring hands-on practical and real-world knowledge to the training sessions.

Yes, participants typically receive access to course materials, including recorded sessions, assignments, and additional resources, even after the training concludes.

We provide placement assistance to students, including resume building, interview preparation, and job placement support for a wide range of software courses.

Yes, we offer customisation of the syllabus for both individual candidates and corporate also.

Yes, we offer corporate training solutions. Companies can contact us for customised programmes tailored to their team’s needs.

Participants need a stable internet connection and a device (computer, laptop, or tablet) with the necessary software installed. Detailed technical requirements are provided upon enrollment.

In most cases, such requests can be accommodated. Participants can reach out to our support team to discuss their preferences and explore available options.

We offer courses that help you improve your skills and find a job at your dream organisations.

Courses that are designed to give you top-quality skills and knowledge.

Upgrade Your Skills & Empower Yourself