Infibee Technologies provides India’s No.1 GST Filing Training in Bangalore with global Certificate and the Placement Support.

Jumpstart your career with the GST Filing Course in Bangalore, mentored by more than 10 industry experts with experience. Our course consists of affordable fees, practical mock projects, resume and interview training, placement help, and lifetime access to recorded live sessions. Acquire real-world skills in GST filing, compliance, and reporting to unpretentiously enter into the roles that are highly demanded…

Join our GST Filing Training Institute in Bangalore and light up your career future with the best-paid job offers from leading companies.

Live Online :

Launch your career with the GST Filing Course in Bangalore at Infibee Technologies. The course is graduates, accounting experts, and finance professionals. The training is about giving the students the actual skills in Goods & Services Tax (GST) registration, return filing, TDS deductions, and compliance processes. The course is oriented on real-world applications to make the students ready for the roles of accounting and finance.

Being the top GST Filing Training Institute in Bangalore, Infibee Technologies provides certification and placement assistance. The trainers with more than 10+ years of industry experience allow the students getting the practical exposure through live sessions, mock projects, and preparing resumes and interviews. The students get lifetime access to the recorded sessions and practice with the tax software.

| GST Filing Course Topics Covered | Applications of GST Filing Training | Tools Used in GST Filing Training |

|---|---|---|

| GST Registration & GSTIN | Corporate Accounting & Compliance | Tally ERP 9 |

| GST Return Filing (GSTR-1, 3B, 9) | Tax Advisory & Consultancy | QuickBooks |

| Input Tax Credit (ITC) Management | Payroll & HR Tax Management | Zoho Books |

| TDS Calculation & Filing | Financial Auditing | MS Excel |

| E-way Bill & Invoice Management | Government Reporting | ClearTax Software |

| GST Amendments & Updates | Business Tax Planning | GST Portal Tools |

| Practical Mock Projects | Accounting & Bookkeeping | SAP FICO |

Experienced Trainers: Learn from 10+ years industry professionals.

Hands-On Training: Real projects and live case studies.

Placement Assistance: Resume building, mock interviews, and job support.

Lifetime Access: Revisit recorded sessions anytime.

Affordable Fees: Quality training at budget-friendly rates.

Key Highlights:

Located at the heart of Bangalore, Infibee Technologies has been recognized as the foremost GST Filing Training Institute in Bangalore. We offer a systematic, industry-oriented GST filing training program that provides the learners with hands-on expertise necessary to perform taxation compliance activities in real time.

The instructors show the learners the way through the actual GST projects, TDS compliance, and reporting. In addition to mock exercises, resume making, and interview skills training, students are fully equipped for the labor market.

At the end of the program, students are awarded a GST Filing certification that is recognized worldwide and that proves their GST compliance expertise and thereby careers getting better.

Our alumni have secured positions in top MNC companies such as TCS, Infosys, Wipro, Cognizant, and HCL Technologies.

| S.No | Certification Code | Cost (INR) | Certification Expiry |

|---|---|---|---|

| 1 | GSTF101 | 15,000 | 3 Years |

| 2 | GSTF102 | 12,000 | 3 Years |

| 3 | GSTF-PRO | 25,000 | Lifetime |

| 4 | GST Filing Expert | 20,000 | 5 Years |

Job-ready skills in GST filing & compliance

Hands-on exposure with real projects

Certification improves employability

Placement assistance in top companies

Practical knowledge of accounting software

Resume and interview preparation

Flexible learning modes

GST registration and GSTIN management

GST return filing (GSTR-1, 3B, 9)

Input Tax Credit (ITC) management

TDS calculation and filing

E-way bill and invoice management

Practical hands-on projects using accounting tools

Fresh graduates and students (B.Com, M.Com, CA, CS)

Finance and accounting professionals

Entrepreneurs and business owners

Anyone interested in taxation and compliance

| Experience Level | Job Role | Salary (LPA) |

|---|---|---|

| Freshers / Junior (0–3 years) | GST Filing Executive | 3–4.5 |

| Junior Tax Analyst | 4–5.5 | |

| TDS Filing Associate | 4–5 | |

| Mid-Level (4–8 years) | GST Consultant | 5–8 |

| Senior Tax Analyst | 8–12 | |

| GST Filing Specialist | 8–12 | |

| Senior / Experienced (9+ years) | Principal Tax Consultant | 12–18 |

| Head of Taxation | 15–20 | |

| GST Filing Advisor | 18–25 | |

| Specialized Roles | GST Auditor | 10–15 |

| TDS Compliance Specialist | 10–15 | |

| GST Implementation Expert | 10–15 |

TCS

Infosys

Deloitte

Wipro

KPMG

GST Filing Training is offered to other cities as well as GST Filing Training in Chennai, GST Filing Training in Hyderabad, GST Filing Training in Delhi, and GST Filing Training in Pune. While Infibee Technologies is providing hands-on training, experienced mentors, and placement support, which goes hand in hand with what candidates look for specifically in Bangalore, that is what makes us the number one choice.

Step 1: Register for a Free Demo

Visit our website and submit the inquiry form.

Participate in a free demo session to understand our teaching methodology.

Step 2: Select Your Training Mode

Choose classroom, online, or corporate training.

Confirm your batch timing and convenience.

Step 3: Start Your GST Filing Course in Bangalore Journey

Learn from expert instructors.

Work on real projects and get ready for GST Filing Classes in Bangalore certification.

Get your career going with Infibee Technologies, the best GST Filing Training Institute in Bangalore. Get hands-on experience, get certified, and be ready to land well-paying jobs in well-known companies.

Upgrade Your Skills & Empower Yourself

Join our GST Filing Training in Hyderabad ! Our syllabus covers essential GST filing methodologies, relevant tools, and advanced techniques. Our practical projects are led by industry experts, empowering you to manage GST filing processes effectively in this growing tech hub.

Enroll in our GST Filing Classes in Hyderabad, where our course focuses on providing high-quality training with a strong foundation in core GST concepts and a practical approach to filing returns. Through exposure to real-world GST filing scenarios and current tax regulations, participants will enhance their skills and gain the ability to prepare and file GST returns accurately

Develop a software that automatically calculates GST. Ensure it can file returns directly with tax authorities. Include features for error-checking and compliance.

Create a tool to monitor GST compliance status. Track due dates and send reminders for filing. Offer a dashboard with compliance reports.

Design an app to assist small businesses with GST. Provide step-by-step guidance for filing returns. Include educational resources and tips.

Educate your workforce with new skills to improve their performance and productivity.

Our Best GST Filing Training in Hyderabad aims to empower participants with comprehensive skills and practical knowledge in the field of GST compliance. The objectives focus on mastering core concepts of GST, applying skills through real-world GST filing projects, developing critical thinking to navigate complex tax regulations, and addressing professional challenges.

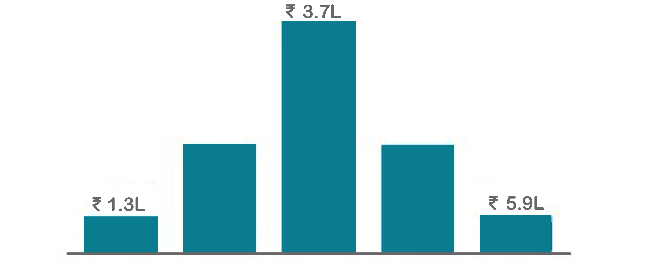

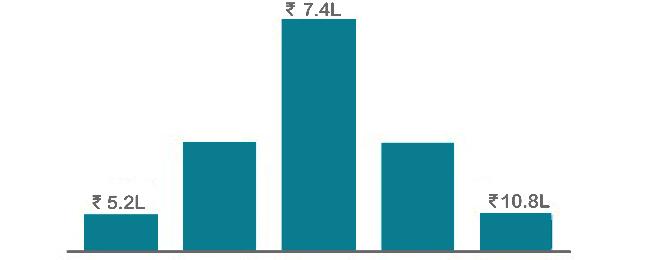

The average salary of a GST Filing Specialist in India ranges from ₹3-5 lakhs per annum for entry-level positions. For experienced professionals, the salary can increase to ₹7-10 lakhs or more, depending on the size of the organization and the complexity of compliance handled.

Yes, there are several certifications available for GST Filing professionals. The GST Practitioner Certification offered by the Indian government is a popular certification. Additionally, several institutes provide GST-specific certifications that focus on return filing, ITC, and tax compliance.0

A typical GST Filing course covers essential topics such as GST registration, return filing (GSTR-1, GSTR-3B, GSTR-9), Input Tax Credit (ITC) management, reconciliation of accounts, E-Way Bill management, and compliance with GST laws. Practical case studies and hands-on practice are also included.

The prerequisites for enrolling in a GST Filing course typically include a basic understanding of accounting and taxation. A background in commerce, finance, or accounting is helpful, but many courses start from the basics, so no specific degree is mandatory for entry-level courses.

After completing a GST Filing course, participants can explore career opportunities as GST Practitioners, Tax Consultants, GST Compliance Executives, Accountants, or Finance Managers. Many companies, especially in the finance and accounting sectors, require professionals to handle GST compliance and filing.

A GST Filing certification enhances career prospects by providing specialized knowledge in GST compliance, which is mandatory for businesses in India. Certified professionals are in high demand as they ensure legal adherence to tax regulations, making them valuable in accounting firms, corporate tax departments, and as independent consultants.

Our Job Assistance Programme offers you special guidance through the course curriculum and helps in your interview preparation.

GST Filing is the most common programming language, and it works on all computers and mobile devices without needing to be upgraded. It is one of the highest-paying careers in the software development industry, and those with the GST Filing certification can earn an average of 7 LPA per year.

Infibee’s placement guidance navigates you to your desired role in top organisations, ensuring you stand out and excel in every opportunity.

You need not worry about having missed a class. Our dedicated course coordinator will help them with anything and everything related to administration. The coordinator will arrange a session for the student with trainers in place of the missed one.

Yes, of course. You can contact our team at Infibee Technologies, and we will schedule a free demo or a conference call with our mentor for you.

We provide classroom, online, and self-based study material and recorded sessions for students based on their individual preferences.

Yes, all our trainers are industry professionals with extensive experience in their respective domains. They bring hands-on practical and real-world knowledge to the training sessions.

Yes, participants typically receive access to course materials, including recorded sessions, assignments, and additional resources, even after the training concludes.

We provide placement assistance to students, including resume building, interview preparation, and job placement support for a wide range of software courses.

Yes, we offer customisation of the syllabus for both individual candidates and corporate also.

Yes, we offer corporate training solutions. Companies can contact us for customised programmes tailored to their team’s needs.

Participants need a stable internet connection and a device (computer, laptop, or tablet) with the necessary software installed. Detailed technical requirements are provided upon enrollment.

In most cases, such requests can be accommodated. Participants can reach out to our support team to discuss their preferences and explore available options.

We offer courses that help you improve your skills and find a job at your dream organisations.

Courses that are designed to give you top-quality skills and knowledge.

Upgrade Your Skills & Empower Yourself